bespoke payment solutions

for your business

We act as brokers for corporate clients in the EU who want to access a business payment account. Transforming Cash into bank deposit. Available at any time and everywhere.

Let’s let flow, what we love so much…

Who is Entpaysos?

We are a international team of experienced specialists in different industries. We bring a broad knowledge from the financial industry and open our network to find a suitable payment solution for your business. Our focus is on finding the right partners for you to connect cash from day-to-day business with an online payment account.

The Situation: Permanently

rising Hurdles

A bank account enables participation in digital payment transactions and is a matter of course for many companies.

Unlike an account for private customers, where consumer protection has set the hurdles for rejecting an account application very high, it is becoming increasingly difficult for companies in more and more sectors to open an account. Here, banks are largely free to choose their business partners.

For various reasons, commercial banks are becoming restrictive when it comes to opening business customer accounts in certain sectors:

Increasing workload, rising costs and higher risks are leading many banks to reject business relationships with companies from so-called critical industries due to business policy considerations.

As a result, no new business accounts are opened and existing accounts are closed by the banks.

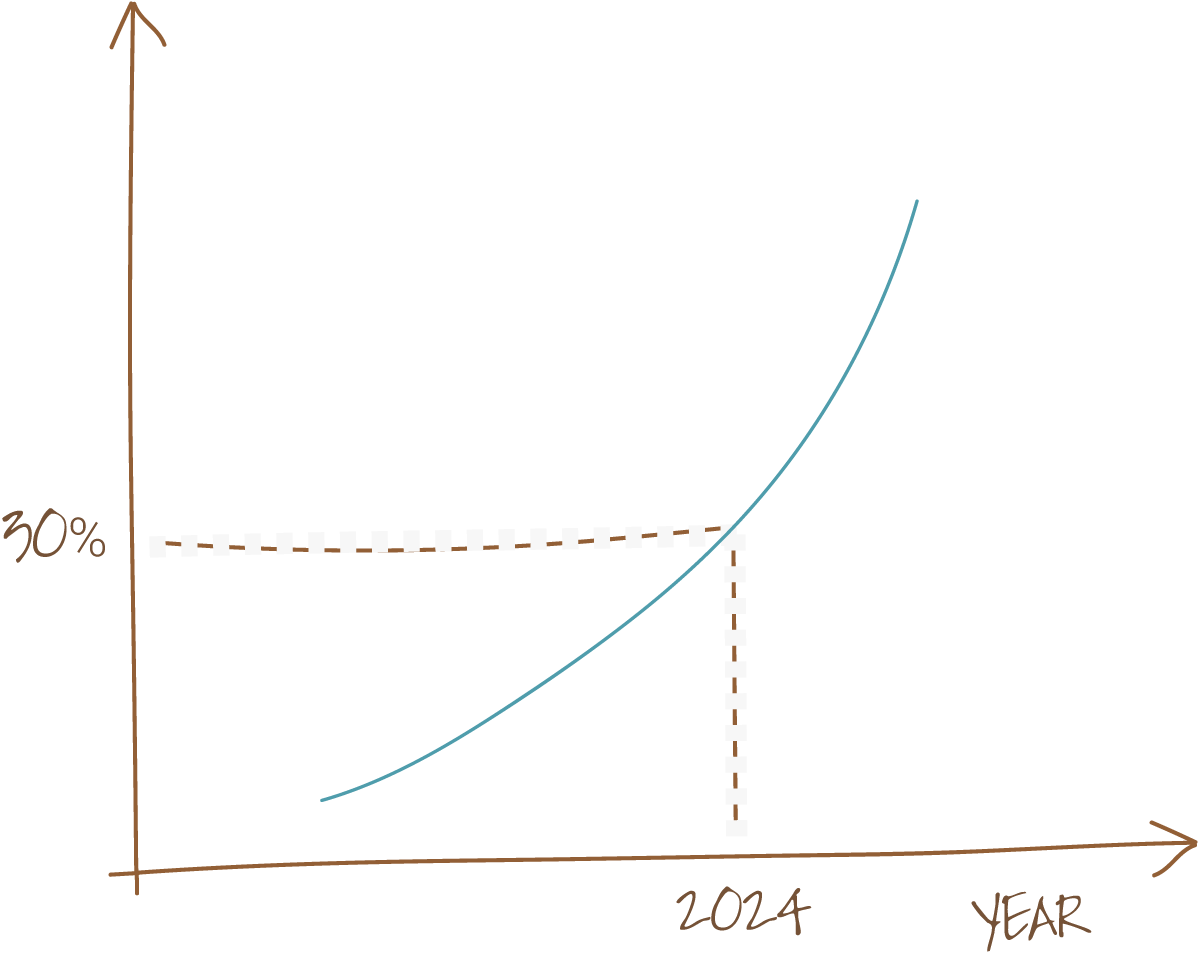

Share at companies in German Gaming without a bank-account

In recent years, german retail banks have become increasingly restrictive with their business policies in the gaming industry. The share of companies without a bank-account is growing steadily. Companies that still have an account today will also be affected.

Source: Gemeinsame Geschäftsstelle Glücksspiel (Joint Gambling Office), Expert Interviews, Own Illustration

The Entpaysos Promise

We work with you to find a suitable solution so that you can participate in digital payment transactions. We do not mask the symptoms – we do not half fix the problem but transform all your cash into your own bank account.

Entpaysos is a recognised broker and has already brokered seven-figure amounts in its first year of existence – become part of our market-leading solution now!

There are many financial institutes in Europe that specialize in individual sectors. They know the requirements and risks in ‘their’ sector very well and can deal with them professionally. They do not reject a business relationship with companies from this industry in general, but examine the respective requirements very carefully on an individual basis. We know these banks and bring them together with your company. We know the banks’ requirements and advise you on how to meet their expectations.

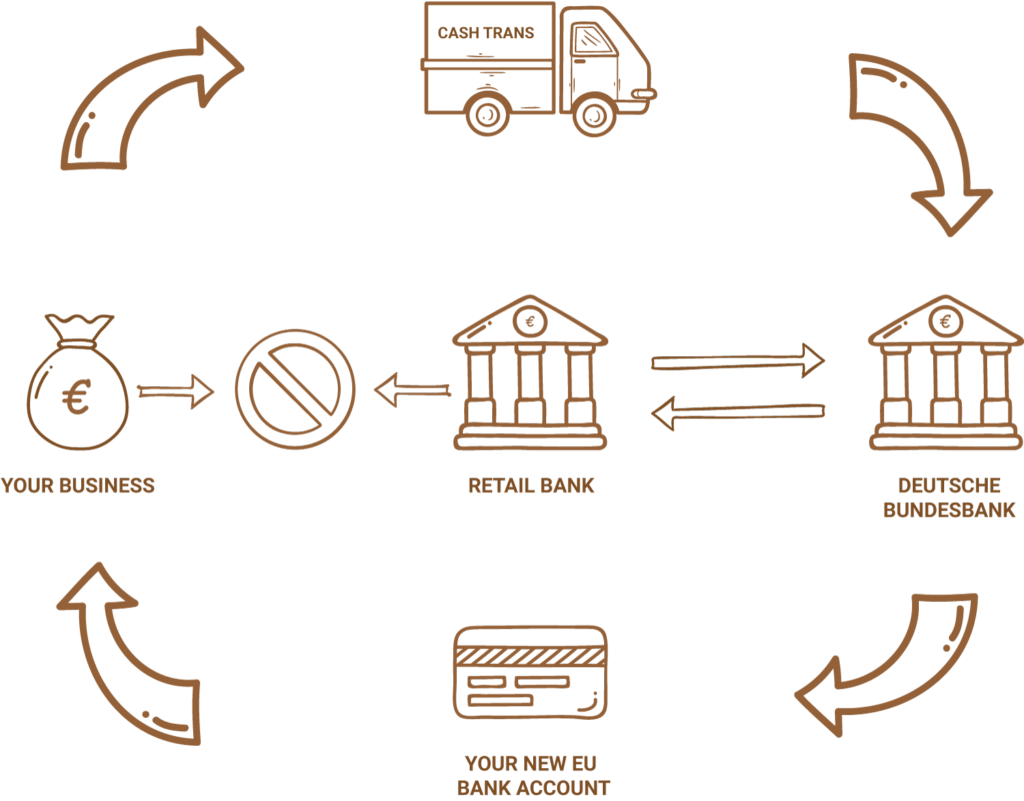

But how can a bank help me if it’s not near me and I can’t deposit cash there?

You pay Entpaysos a one-off brokerage fee of EUR 750

The banks we are working with, charge different fees. These depend very much on the risk class of the company, but should generally not exceed 1% of transaction amount.

If other partners, such as money transportation companies, are involved, they charge their fees separately.

Entpaysos specializes in providing banking solutions for businesses often overlooked by traditional banks due to their industry or specific financial needs. Our expertise lies in understanding unique business challenges and offering personalized banking access and financial services, emphasizing flexibility and support not typically found in conventional banking.

The process starts with a consultation to understand your business needs. We then guide you through the application, leveraging our network to find a suitable banking partner. Our team assists with paperwork and compliance, aiming for a smooth and efficient account setup. You’ll be supported every step of the way until your account is operational and beyond.

What are the expected fees when using Entpaysos, including any bank or third-party charges?

– We strive for transparency in all our fees. Clients can expect a one-time success fee for account setup through Entpaysos. Additional charges may include bank-specific fees and any third-party service costs, which we’ll disclose upfront to avoid surprises.

Entpaysos adheres to strict security protocols and uses advanced encryption to protect digital transactions and client information. We continuously update our systems to combat emerging threats, ensuring your data’s safety and confidentiality.

Businesses in high-risk industries, startups, and those facing challenges with traditional banking due to their innovative models find great value in our services. We specialize in sectors like technology, e-commerce, and others that benefit from flexible and understanding financial solutions.

The timeline can vary based on the specific requirements and background checks required by our banking partners. Typically, businesses can expect to start using their corporate account within two to three months from the start of the process.

Entpaysos supports international transactions, offering guidance on navigating exchange rates and fees. We assist businesses operating globally with tailored solutions that consider the legal and financial complexities of multiple countries.

Entpaysos partners with highly reputable and secure cash transportation services to ensure your cash is safely collected and delivered to the German central bank. Our process includes end-to-end secure handling, real-time tracking, and insurance coverage to guarantee the utmost safety of your funds from your business location to the bank. This meticulous approach allows us to offer an efficient and worry-free cash management solution for our clients.

Absolutely. Entpaysos specializes in optimizing cash handling operations for businesses. Our service significantly reduces the manual effort and resources your business needs to allocate for cash management. By taking over the logistics of cash collection and depositing, we free your team to focus on core business activities, enhancing overall operational efficiency and productivity.

Partnering with Entpaysos offers businesses in cash-intensive sectors a unique competitive advantage by transforming the traditionally cumbersome cash management process into a streamlined and secure operation. Our direct connection with the German central bank ensures reliable and timely deposits, enhancing your cash flow management. Furthermore, by leveraging our expertise and established infrastructure, you benefit from reduced operational risks and improved financial liquidity, allowing you to reinvest in growth opportunities more quickly and with greater confidence through your new business bank account.

Shoot us a message. Do not hesitate any

longer to finally convert cash into bank credit.

With Entpaysos Cash is not longer a burden

but the gateway to being able to spend it again.

Click the button below to get to our application form.

© 2024 All rights Reserved · Entpaysos Ltd.

Welcome to Entpaysos. To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behaviour or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

We will get in touch with you as soon as possible. Have a nice day – your Entpaysos Team.